Professional Development

Professional Diploma in Finance (with Specialization)

Gain a Professional Diploma in Finance with this comprehensive and interactive 16-week online programme that covers a wide range of financial topics. Choose from 5 different areas to specialize in.

COURSE OVERVIEW:

- 16 week online programme

- Unlimited Tutor Support

- 12 Modules

- Choose from 5 areas to specialize in

- Gain a Professional Diploma that is Credit Rated by Glasgow Caledonian University

Download a course brochure today for more information.

OVERVIEW

Course Information

Our Professional Diploma in Finance is a comprehensive and interactive 16-week online program that covers a wide range of financial topics. The course is designed to give you a solid understanding of financial concepts and their practical applications.

🎯 What You Will Learn

Case study approach

You will learn how to analyse real-world financial scenarios and apply your knowledge to solve problems and make strategic financial decisions.

Company analysis techniques

You will learn how to evaluate a company’s financial performance and identify critical areas for improvement.

Bookkeeping

The purpose of this module is to build on skills and develop bookkeeping skills, and apply the principles of advanced double-entry bookkeeping.

Management Accounting

This module develops the concepts of management accounting and costing. Upon completion, students will be able to understand the use of management accounting within an organisation.

Final Accounts

This module helps students to understand financial reporting requirements. Upon completion, students will be able to understand the need for final accounts and principles of their preparation.

Ethics

This module introduces students to professional ethics in an accounting environment. Upon completion of this course, students will understand the need for accountants to act ethically

Financial Statements of Limited Companies

This module provides the skills and knowledge to draft, analyse and interpret the financial statements of limited companies.

Budgeting

This module covers the use of budgeting for planning, coordinating, authorising and controlling the activities and costs of a business.

Cash Management

This module covers the key principles of effective cash management, enabling you to identify how cash moves through a business and how you can maximise your returns.

Credit Management

This module teaches the principles of effective credit control and important techniques to assess credit risk, which you can use to improve the credit control system and policies within an organisation.

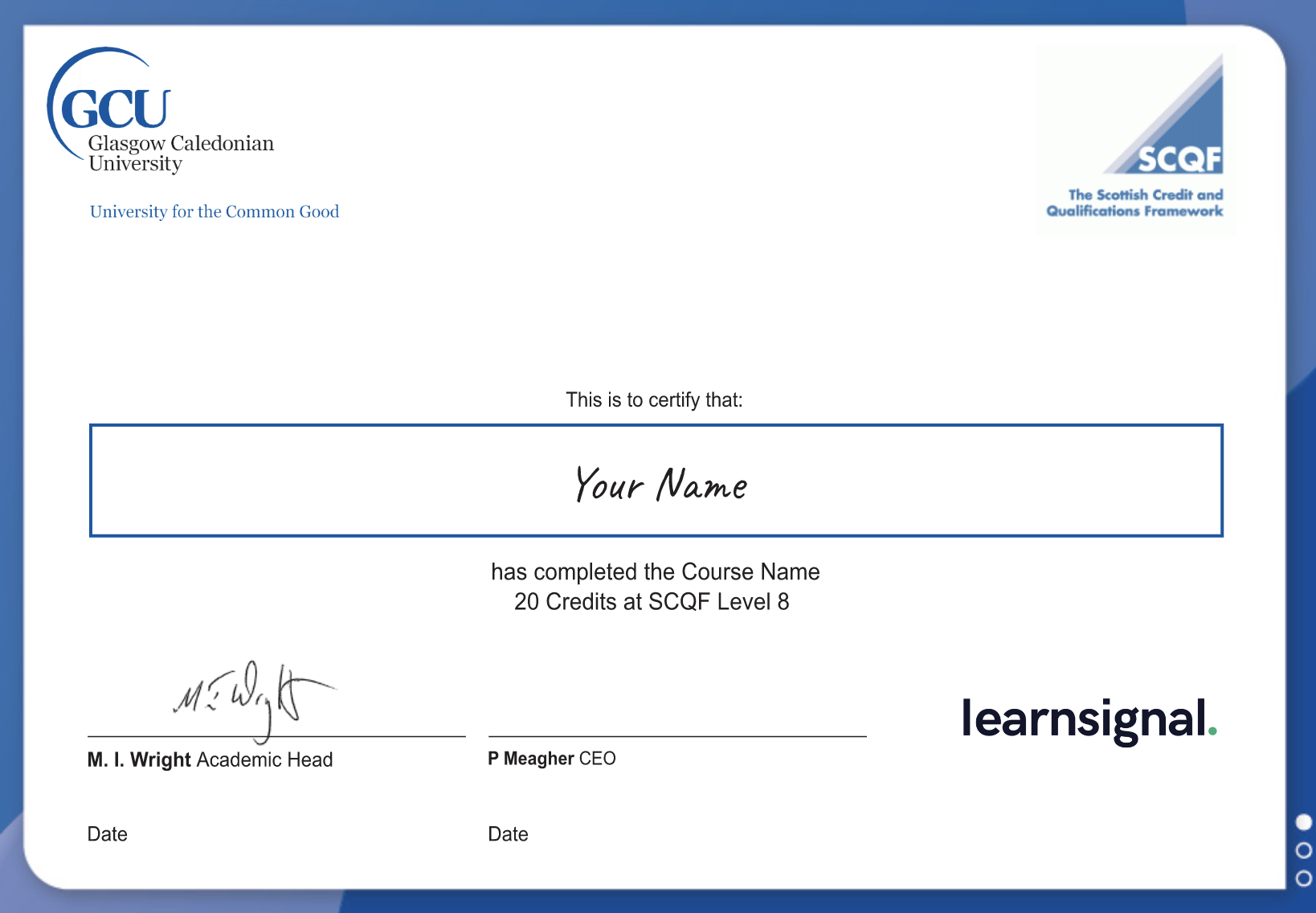

Glasgow Caledonian University Credit Rated

GCU Credit Rated means that a course or program is recognised by Glasgow Caledonian University (GCU) as having met the university’s standards for academic quality and rigour. This means that the course or program has been evaluated by GCU and has been found to be in line with their expectations for content, delivery, and assessment.

- Gain 20 SCQF Level 8 Credits on completion

- 1 credit is equivalent to 10 hours of learning

💼 How You Will Learn

Online lectures and readings

You will have access to pre-recorded lectures and readings covering each course’s material. These can be accessed anytime and can be paused, rewound, or reviewed as needed.

Discussions and Collaboration

You will have opportunities to engage in online discussions with your classmates and instructors.

Self-directed learning

You will be encouraged to take an active role in your learning process by reading additional materials, conducting research, and engaging in other self-directed activities.

Assessments and Quizzes

You will complete regular quizzes and assessments to test your understanding of the material and help identify areas where you need further study.

Support

You will have access to support services such as tutoring and academic advising to help you succeed in the program.

Each student will have a choice of areas to specialize in. Depending on what area you specialze in will determine which two additional modules are included within the course, and also determine the final area of your diploma. The choices for specialism, and the additional modules you will study, are:

- Professional Diploma in Finance & Governance – Corporate Governance and Capital Budgeting

- Professional Diploma in Finance & Project Development – Accounting for Programme Management and The Role of Business Analysis

- Professional Diploma in Finance & Team Management – Building a Successful Finance Team and Effective Appraisals

- Professional Diploma in Finance & Risk – The Basics of Risk Management & Governance and Cyber Risk Management and Reporting

- Professional Diploma in Finance & Leadership – Emotional Intelligence and Motivational Leadership

PRICING

Tuition Cost 💶

Course Fees include all materials and assessment fees.

- Full access to content and resources

- Unlimited Tutor Support

- Capstone Assessment included

- Course Fee for 2024: £1500

Bursaries and funding may be available, get in touch with our team to discuss your options.

Testimonials

Alumni Stories 🙌

Join thousands of students who have transformed their careers with learnsignal! You’ll be in good company at learnsignal!

Approved Accounting & Finance Tuition Providers

Approved ACCA, CIMA & AAT Tuition Partners. Since becoming approved providers we have continued to challenge the traditional way of learning and grown our student base across 130 countries.

Used by Students and Members from

Accredited Courses by

FAQs 🤔

Doubts cleared here. No confusion.